Top Bitcoin ecosystem Airdrops to watch for the rest of 2024/2025

Over 20 Airdrops/testnets | How to use filters in Dexscreener to analyze memecoins

Cryptofada is a crypto income/investment opportunity newsletter. We save you time by curating the best research and opportunities in crypto so you can learn/invest and become a consistently profitable investor/trader.

👉 Every Monday, you will read about Defi Yield farming, Staking and Crypto trading

👉 Every Thursday/Friday, you will read about Airdrops, Testnets, ICO/IDO/Presales (Public and Private)

In addition to feedback, it will mean the world to me if you share the newsletter now to a friend or colleague. Send your feedback/mails to cryptofadainfo@gmail.com

OUTLINE

1. Bitcoin ecosystem: Projects with Airdrop Potentials

2. Other Airdrops and testnets

3. Crypto Trading - How to use filters in Dexscreener to analyze memecoinsBitcoin ecosystem: Projects with Airdrop Potentials

MezoNetwork: Mezo is the Bitcoin Economic Layer: A Bitcoin-first network with a dual staking model for rewards and validation. Mezo is built by Thesis (The Bitcoin-first venture studio behind several bitcoin products like fold_app, tBTC_project etc). The have received $30M funding from leading funds, including PanteraCapital, multicoincap, hack_vc & others.

Total Value Locked of $118.56m as at the time of writing this.

What to do: The Mezo Portal enable Bitcoin holders to participate in DeFi activities without losing exposure to BTC, hence join the portal and deposit BTC. If you need a step-by-step guide specifically for this, drop a comment below and I will share.

Mezo recently launched a validator program which will be leading into Testnet Launch.

Also, if you are a founder or team looking to take your project to the next level, join their Bitcoinfi accelerator program to get the support you need. Applications close next week, October 23rd.

Lombard Finance: LBTC is a Bitcoin LST, built on top of Babylon, free to be put to work in DeFi. Lombard is currently in Public Beta on Ethereum mainnet, Binance Labs just invested into Lombard. The funding will accelerate the evolution of LBTC into a core primitive, or the stETH of BTC, empowering DeFi protocols to onboard LBTC so that everyone can do more with their Bitcoin. From today, BNB Chain users can stake BTCB and receive LBTC to benefit from staking rewards. Institutional users’ needs are catered to by entrusting CeffuGlobal as a custodian.

TVL: Since its launch in August (just 6 weeks ago), Lombard has grown to hold 40% of the Bitcoin LST market, with a Total Value Locked (TVL) of over $640million or 9.5K BTC, from over 13,000 users, according to data from Dune. Lombard is the largest contributor to babylonlabs_io Cap-2, taking 30% of the cap with 7,166 BTC staked.

What to do: Particiapte on the protocol https://www.lombard.finance/app. First, Lombard's Flash Event deposit period closed, all LBTC must be held until 24th October to be eligible for double Lux. If you need help, leave a comment.

Babylon: This is a Btc staking platform. according to their document, their vision “is a Bitcoin-secured decentralized world, with staking as the first step. We’ll keep building new protocols like trustless bridges and liquidity marketplaces, making Bitcoin a cornerstone of the blockchain world.” Babylon's Phase-1, Cap-2 staking just wrapped up, and the numbers are in! Over 22,891 BTC staked in just 1h27m across 12,641 unique addresses. The staking dApp saw over 2 million visits during the 10-block duration cap.

What to do: If you have been following us, I am sure you must have participated in the Babylon’s testnet. They are not done, as we know there are slowly releasing various phases of the project, and a lot of airdrops are on the way. Read about the AMA with Babylon co-founder Fisher Yu to dive into Babylon’s mainnet launch, Bitcoin staking, and the exciting roadmap ahead

Fractal_bitcoin: Fractal Bitcoin: a recursive blockchain computing system. It’s the only Bitcoin scaling solution that uses the Bitcoin Core code itself to recursively scale unlimited layers on top of the world’s most-secure and -held blockchain. UniSat and Block Space Force, the core contributors, have developed protocols and applications that have been used by millions of users around the world. It's one month since Fractal's mainnet launch. They have successfully launched an explorer, marketplace, wallet, inscription platform, simple bridge, PizzaSwap, and more for their Fractal ecosystem. 3 Protocols are currently supported such as BRC-20, Runes (How to set up and fund your rune wallet), and CAT Protocols (check this - advoCAT4 protocol launch is getting closer). Over 37,000,000 addresses created and a total of 300,000,000 transactions since launch. Currently, Fractal maintains 750,000 active addresses (24H) and 16,000,000 transactions (24H). We also have 140+ projects in the ecosystem.

For what is next, check out the public road map: http://build.fractalbitcoin.io

What to do: First, participate on its core three protocols. Second, if you are a developer, Fractal Ecosystem Grants Season 2 applications are now open from October 15, 2024, to December 15, 2024. You can submit your applications at the link here. The final list of recipients will be announced at the end of December

Unisat_wallet: UniSat is a blockchain service provider that offers comprehensive support for inscribing and trading Ordinals/BRC20 on the Bitcoin network. Unisat recently announced that UniSat Marketplace is officially available on the Fractal Bitcoin mainnet. You can now browse and trade Runes seamlessly on the platform. You can access the Marketplace here: https://fractal.unisat.io/runes/market as well as the fee structure here.

Stacks: A Bitcoin L2 enabling smart contracts & apps with Bitcoin as secure base layer. TVL: $106.01m

What to do: Participate by following this BTC yield strategies that are emerging on Stacks - What will make BTC yield possible on Stacks? sBTC, a 1:1 Bitcoin-backed asset arriving in Q4, will enable builders to integrate BTC into DeFi. Unlike other tokenized BTC assets, sBTC is trust-minimized as it's: Non-custodial and Relies on an open set of signers. How will users earn yield with sBTC? Various Stacks DeFi protocols will integrate sBTC to generate sustainable BTC yield.

• Zest Protocol- Bitcoin lending

• Granite is an upcoming BTC lending app on Stacks. BTC lenders will earn yield from interest paid by borrowers

• Bitflow - As an aggregator DEX, Bitflow will facilitate seamless swaps between BTC, tokenized BTC, and Stacks assets

• Velar - Velar will implement BTC liquidity pools for their DEX, enabling yield generated from sBTC pool swaps.

Click here to dive into all 4 of these Stack DeFi apps

Other Airdrops and testnets

How not to miss the next Optimism Airdrop

So many people missed the Optimism Airdrop 5, A few days ago yet many users were surprised to receive over $1000 airdrop. Get ready for Airdrop 6 as up to 550M $OP is remaining for the next Airdrops. Optimism is an EVM-compatible optimistic rollup blockchain platform built on top of Ethereum. Raised: $267.5M from a16z, Paradigm, and IDEO CoLab Ventures.

What to do:

• Visit the website and create an account if you don't already have one

• After that, you can participate in proposals and vote by delegating tokens

• Interact with the networks and apps from these lists https://superchain.eco/chains https://superchain.eco/projects

• Transfer tokens via these bridges https://app.optimism.io/bridge/deposit

• Swap tokens in OP network and spend gas (during the second season, you had to spend at least $20 on gas)

• Also, stake tokens on OP network

• Complete the tasks on Layer3 (deadline: November 4) https://app.layer3.xyz/campaigns/supercharge-op…

• You can create NFTs on Super chain using Zora and invite your friends to mint your NFTs https://zora.co/create

Join Cronos zkEVM Pioneer Program

The Cronos zkEVM Pioneer Program is a reward program enabling you to earn points whenever you bridge funds into the Cronos zkEVM chain and use dapps.

It was launched on August 15, 2024. Your point balance will be converted into a reward balance in participating cryptocurrencies. For example, your rewards may include some zkCRO tokens and tokens from other partner Dapps.

The first season runs from August 15, 2024, for 8 to 12 weeks, with the exact end date to be announced in mid-September.

How can you maximize your points?

Some mission tasks need to be completed only once, for example social tasks. Other tasks bring a variable number of points depending on the value of the funds that you bridge or trade. Other tasks yet can be repeated every day to accumulate an ever-growing number of points. You can track your points on the Cronos Pioneer Program page by connecting your wallet or visit the leaderboard if you are curious. Here’s a more detailed guide on mission tasks, so you can formulate your best strategy and get the most out of every interaction. Each task below corresponds to a dedicated action link on the Pioneer Program page.

Here's how I bridged funds to this new L2: Bridging funds to Cronos zkEVM Gas is paid in the form of zkCRO (different from CRO). The easiest way to get funds on Cronos zkEVM is by bridging CRO with the mainnet bridge. https://zkevm.cronos.org/bridge/ But the gas fees on Ethereum are expensive. So, it’s not worth it if you're bridging a small amount of funds. Here are other options to get funds over:

Use @gasdotzip to refuel zkCRO

Use the http://Crypto.com app to bridge CRO from Cronos-to-Cronos zkEVM

Bridge ETH to Cronos zkEVM and use the Paymaster contract to swap ETH to zkCRO

Your Path to the $100K Prize Pool by Cronos

Over the next few weeks from 3 Oct - 7 Nov 2024, you’ll compete to top the leaderboard by bridging $ETH from Ethereum mainnet to Cronos zkEVM, performing swaps and adding liquidity on H2 Finance. With $20,000 up for grabs each week, the race is on.

How to Participate: Your Path to the $100K Prize Pool

Ready to join the race? Here’s how you can secure your spot on the leaderboard and race to the top:

Bridge Your ETH:

Visit the official bridge page: https://zkevm.cronos.org/bridge

Transfer $ETH from Ethereum mainnet to Cronos zkEVM. (You may request either vETH or ETH on the other side of the bridge).

The more $ETH your bridge, the higher your score

Deposit early to unlock higher multipliers for each round

When you bridge ETH, you also accumulate points for the Pioneer Program, which can translate into additional rewards!

Withdrawing and redepositing the same ETH won’t earn points—only new ETH deposits count. Any withdrawal or offloading of deposits is counted as a negative deposit.

Swap on H2 Finance:

Perform a minimum swap transaction of US$50 on H2 Finance to qualify for leaderboard scoring during this particular week: https://h2.finance/swap

You will need to perform this task weekly to qualify for each week’s leaderboard race

Add liquidity on H2 Finance:

Add a minimum of US$100 liquidity on H2 Finance to qualify for leaderboard scoring during this particular week: https://h2.finance/add

You will need to perform this task weekly to qualify for each week’s leaderboard race

Maximize Your Points:

Boost your race score by bridging more $ETH

Deposit early for multiplier bonuses

Avoid wallet withdrawals during the campaign period to keep your deposit scores as high as possible

Weekly Leaderboard Reset:

Every week, the leaderboard resets, giving you a fresh chance to climb to the top.

Rankings reset weekly, but withdrawals are tracked across rounds

Visit the Race Score leaderboard to check your ranking: https://zkevm.cronos.org/missions?eth=leaderboard

$20,000 Weekly Prize Pool:

Each round offers $20,000 in zkCRO to be shared among the top users on the Race Score leaderboard, based on their final scores.

For Lap 1: the top 50 users are eligible to prizes.

From Lap 2 onward: the top 200 users are eligible to prizes.

Final Snapshot:

At the end of each week, a snapshot of race scores will be taken to determine the users eligible for the prize pool sharing

Prize Distribution:

Eligible users will receive their rewards via an airdrop directly to their wallets after each week.

Join the Zircuit Liquidity Hub - Stake to earn

Zircuit has teamed up with ecosystem partners to supercharge your staking. Stake to earn airdrops from zerolendxyz, ElaraLabs, avalonfinance_, gmCircuit, OcelexFi, GammaStrategies and more.

Why use Liquidity Hub? A one-stop-shop to earn layered rewards, like staking yield, protocol tokens, points, and future airdrops. Join Discord.

Seraphnet is announcing the official launch of the 10M $DLLM token airdrop to support the beta testing phase for their Clearpill platform. This airdrop will provide direct incentives to active participants as we refine the UI/UX, smart contract interactions, and AI functionality.

Here’s how you can participate:

1. Sign up for the beta testing phase (details to be announced).

2. Complete assigned testing tasks across the platform, including UI/UX and smart contract functionality.

3. Provide detailed feedback to qualify for the $DLLM airdrop

To stay informed on how to participate and qualify for the airdrop, join our community: • Discord: https://discord.com/invite/Ubf2d4g6zg… • Github: https://github.com/Seraphnetai More details on the beta testing process and airdrop eligibility will be released soon.

Yala is the Liquidity Layer for Bitcoin. Backed by Polychain, EtherealVC & more.

With the Yala Testnet, users can deposit, MetaMint $YU, manage their positions, and stake their $YU to earn $BERRIES. If you're a beginner or want to avoid confusion, your best bet is to engage with the Yala Testnet through the guided Galxe Quest campaign: http://dashboard.galxe.com/quest/yala.

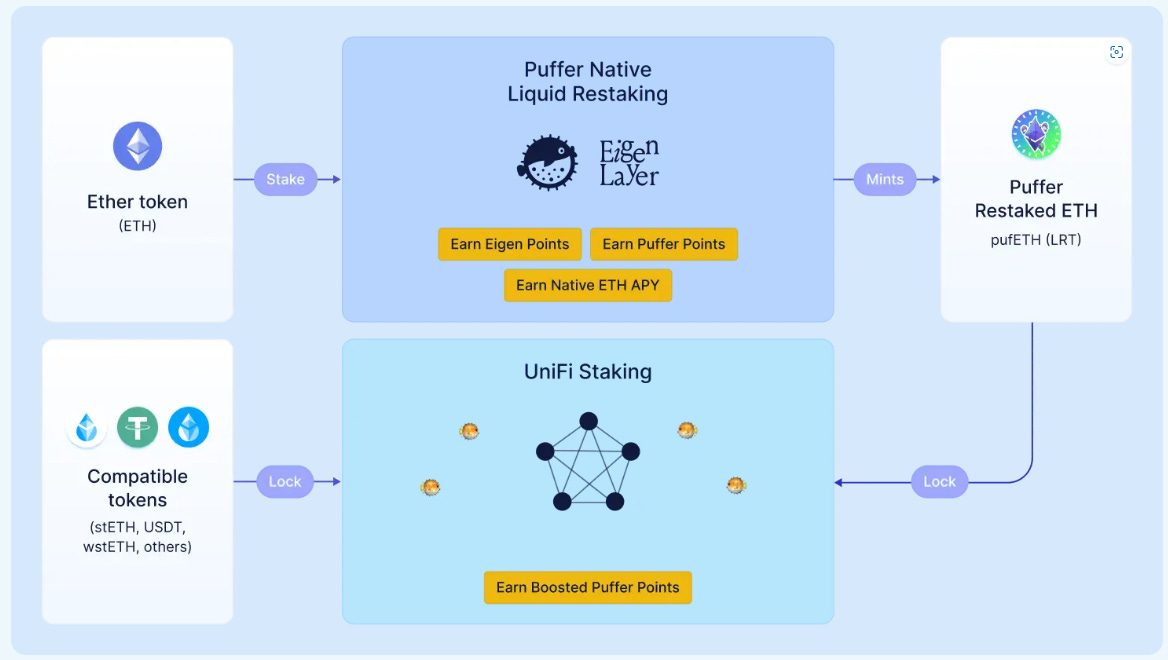

$PUFFER is the cornerstone of all our products: - The first permissionless LRT. - The first based rollup with instant withdrawal, UniFi Based Rollup puffer_unifi

. - The first preconf service enabling 100ms transactions on Ethereum, UniFi AVS.

The $PUFFER airdrop went live on October 14th, 2024, 11 PM UTC Until January 14th, 2025, 11 PM UTC! Link: https://claims.puffer.fi. Read $PUFFER Tokenomics Breakdown here

Quai Network Incentive Testnet

Quai Network is the first decentralized energy dollar on the only scalable and programmable Proof-of-Work blockchain. During the testnet, Participants can earn rewards from a pool of 10M Mainnet Quai tokens, distributed pro rata based on your Testnet holdings by the end of the Testnet. Testnet includes mining, developing, trading, arbitraging, and social challenges. It’s your chance to be part of the future of thermoeconomics and earn rewards.

ICN Early Access Testnet

Impossible Cloud Network (ICN) is a decentralized, multi-service cloud platform

The project has announced a closed testnet that will be launched on October 21. The public testnet will be available on October 24. Complete the tasks here

1.5% of $ICN tokens are allocated to Fairdrop

To access the testnet, you need to get an OATSoneium together with Astar Network launched LFGM Campaign

Story Protocol is a protocol that aims to create, manage, and license new intellectual property on the blockchain. Soneium is developed by the global company Sony. Raised: $140M from a16z, Polychain Capital, SamsungNext and others. If you need some Sepolia ETH to kickstart your journey on Soneium Minato? Head over to the docs to find out how to get Sepolia ETH in your wallet and bridge it to Soneium Minato.

Crypto Trading

Tokens worth investing

1. $TAO - The $BTC of AI. First of its kind. Strong social narrative. Heavily backed by institutions.

2. $QUNT - The mascot of $INJ. Cult-like following. Zero CEX listings. Meme craze yet to hit $INJ.

3: $WELL - The lending platform for $BASE. 30D Fees generated on WELL $650k vs AAVE $234k ($142mil MC vs $2.3bil MC) $WELL pumped almost 2x from $85M to $155M in just 12 days that's actually insane given that this is a utility pick. Once the memes start cooling off and utility projects start running $WELL will hit $1B soon

60 great Crypto KOL to add to your watchlist

They tell you: "Follow the right people" But who are these "right people"? For many users on 𝕏, finding reliable KOLs to follow is a challenge, so a twitter (X) user has curated a list of 60 great bloggers to add to your watchlist.

Strategies for Memecoin analysis: Many traders hunt for gems on Dexscreener without using filters. With the help of filters, a trader turned 0.19 SOL into 39 SOL in one week. Using dexscreener, next step is to choose the chain you’re trading on. I’ve always preferred Solana, but don’t forget about other popular chains with high volume, like ETH and SUI. Once you’ve chosen your chain, click on "Gainers" and check which tokens have been trending over the last 5-7 days and then filters memecoins as follows:

Very Degen:

> Liquidity: $10,000

> Min FDV: $100,000

> Pair age: 0-48 hours

> 1H txns: 30 transactions

Degen

> Liquidity: $15,000

> Min FDV: $100,000

> Pair age: 1-72 hours

> 1H txns: 110 transactions.

Mid-caps

> Liquidity: $100,000

> Min FDV: $1M

> 24H volume: $1.5M

> 24H txns: 50 transactions.

Larger Mid-caps

> Liquidity: $150,000

> Min Market cap: $1M

> 6H volume: $120,000

Old Mid-caps

> Liquidity: $100,000

> FDV: $200,000-$100M

> 24H volume: $200,000

> 24H txns: 2,300 transactions

> Pair age: 720-2800 hours

Next, save these filters in your browser bookmarks so you don’t lose them. Next, choose a coin and check it for a rug pull. For that, use Rugcheckxyz for Solana or CoinScanDeF for EVM. Make sure the smart contract is safe and that the coin is worth buying. Also, don’t forget to check the social media presence. Whether it’s a Twitter community, Telegram group, or the coin’s Twitter account, you need to gauge how much the community is ready to push the coin to new ATHs. Follow Enoinel @lenioneall