OUTLINE:

1.Education: How to rehypothecate ETH via Eigenlayer

2. Latest funded Projects

3. Weekly Token Unlocks: 15-21 JULY 24

4. Defi Yield OpportunitiesIn addition to feedback, it will mean the world to me if you share the newsletter now to a friend or colleague. Send your feedback/mails to cryptofadainfo@gmail.com

Education: How to rehypothecate ETH via Eigenlayer

In tradifi, Rehypothecation is a practice whereby banks and brokers use, for their own purposes, assets that have been posted as collateral by their clients. Clients who permit rehypothecation of their collateral may be compensated either through a lower cost of borrowing or a rebate on fees. Rehypothecation occurs when the lender uses its rights to the collateral to participate in its own transactions, often with the hopes of financial gain. Hypothecation occurs when a borrower promises the right to an asset as a form of collateral in exchange for funds

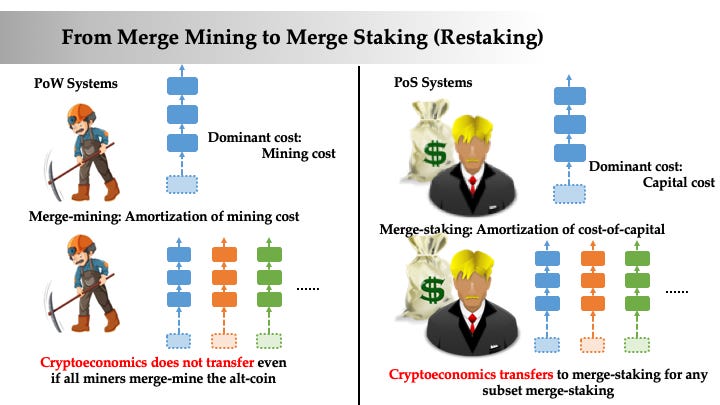

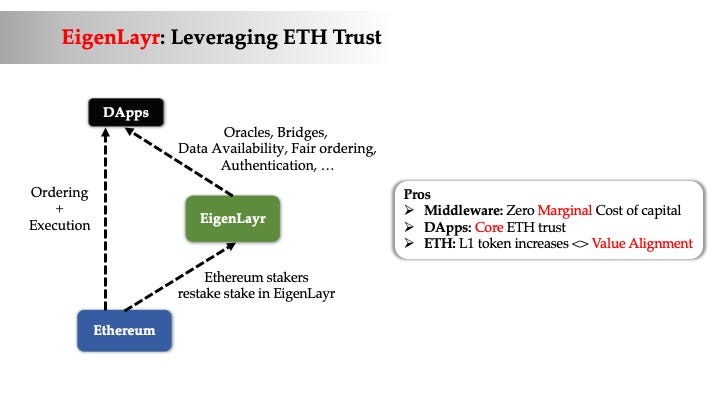

In Defi EigenLayer you can stake ETH to secure Ethereum and stake it elsewhere (without unstaking), in a process called rehypothecated. In the process defi protocols benefit from the security of the Ethereum blockchain because the staked collateral secures Ethereum and the protocol. The user also benefits from double staking yield, one from Ethereum and one from the additional protocol secured.

For the rest of July, here is a 50% discount for our monthly subscription when you subscribe annually using this link

Example Scenario: Imagine you stake 100 tokens in a staking pool with an annual yield of 10%. After one year, you earn 10 tokens as a reward. Instead of withdrawing these 10 tokens, you restake them along with your original 100 tokens, making your total stake 110 tokens. The next year, you earn 11 tokens (10% of 110), and the process continues.

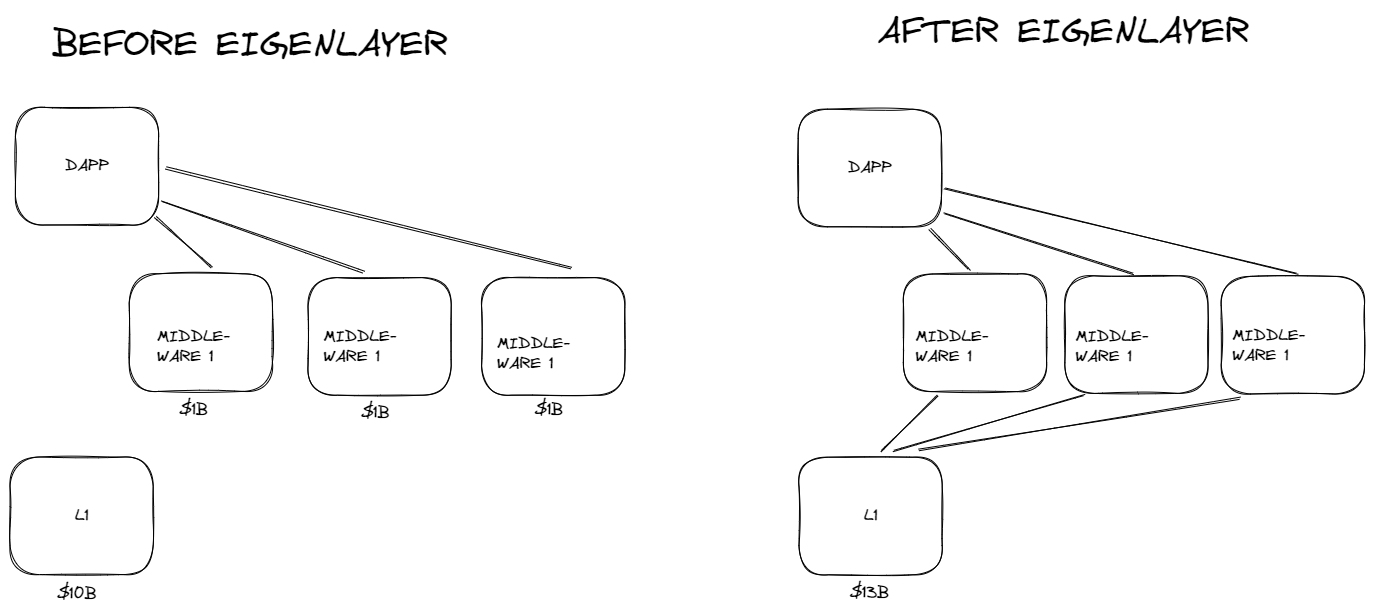

What problems existed with ETH Defi:

1. Innovation on the Ethereum base layer is unnecessarily slow.

2. The reason is fragmented trust.

3. Fragmented trust means applications and middleware have to focus on securing their protocols.

4. That’s costly and diverts attention and capital.

5. Protocols that are not EVM-compatible cannot benefit from EVM incentives.

Generally, fracturing trust across many layers / middlevare poses issues from an economic, security and governance POV.

EigenLayer’s goal is to change the status quo and better align the interests of dApps, middleware services, and Ethereum.

EigenLayr does NOT rely on liquid staking derivatives. E.g. If $10B of ETH is restaked to EL, that is native ETH at risk of being slashed, not a derivative of ETH.

With EigenLayr, Ethereum can focus on long term decentralized governance while anyone is free to permissionlessly add features on top.

EigenLayer introduced their native token EIGEN, which they refer to as an “Universal Intersubjective Work Token”.

Most of this are summarized from the presentation below by @sreeramkannan via Youtube

Latest funded Projects

1. Partior has raised $60M in a Series B funding round, led by Peak XV Partners. Partior is focused on creating blockchain interbank payment systems for instant settlement. The new capital will be used to expand Partior's capabilities in intraday foreign-exchange swaps

2. Ventures_HTX invested $16M in Lombard finance to help accelerate the Bitcoin restaking ecosystem

3. OKX Ventures has invested in Prodia labs, a Distributed Cloud Computing Firm. Prodia is building a distributed network of graphics processing units (GPUs) to provide more efficient cloud computing services at a lower cost using web3 infrastructure

4. RedStone is excited to announce a $15M Series a fundraising round, led by Arrington_Cap to expand its Modular Oracle product

5. Pisquared announce receiving $12.5m in seed funding to build universal verified computing for all! Thank you to our lead investor polychain

Weekly Token Unlocks: 15-21 JULY 24

Keep reading with a 7-day free trial

Subscribe to Cryptofada Research to keep reading this post and get 7 days of free access to the full post archives.