Why 'Superform USDC fixed yield' is the best yield opportunity on Ethereum network

I have been conducting a lot of research on Ethereum yields today, but something became obvious which I want to share here. If you missed some persistent yields from our last post, do well to check it out here:

EXPLOSIVE YIELDS: 30%+ Passive income secrets across 5 hot Crypto ecosystems

Welcome to the thursday edition of Cryptofada research. For partnership, email- cryptofadainfo@gmail.com. Kindly share this newsletter to a friend or more

In the current DeFi landscape, where yield volatility is the norm, Superform USDC Fixed Yield presents a compelling case for investors seeking predictable, low risk returns.

I am not particularly a fan of Ethereum currently because Ethereum (ETH) is currently trading at $1,900, showing bearish momentum across multiple timeframes. The second-largest cryptocurrency by market cap has declined by about -18% in 30 days, and on defi, has had decrease of about _8% when compared to TVL of other chains. The asset's current market capitalization stands at approximately $119.77 billion, with 24-hour trading volume reaching $384.84 billion. ETH's fully diluted valuation is estimated at $125.55 billion. Price metrics indicate a trading range between $2.84 billion and $489.93, with liquidity figures showing a 1.92 ratio. The 24-hour volume splits show $1.36 million and $4.96 million across buying and selling activities.

However, Superform USDC has seen growth on the Built-on Pendle’s yield-trading infrastructure, this strategy enables stablecoin holders to earn a fixed yield with zero price volatility, all while maintaining instant liquidity. But does it truly offer the best yield on Ethereum? Let’s dive in.

How Superform USDC fixed yield works

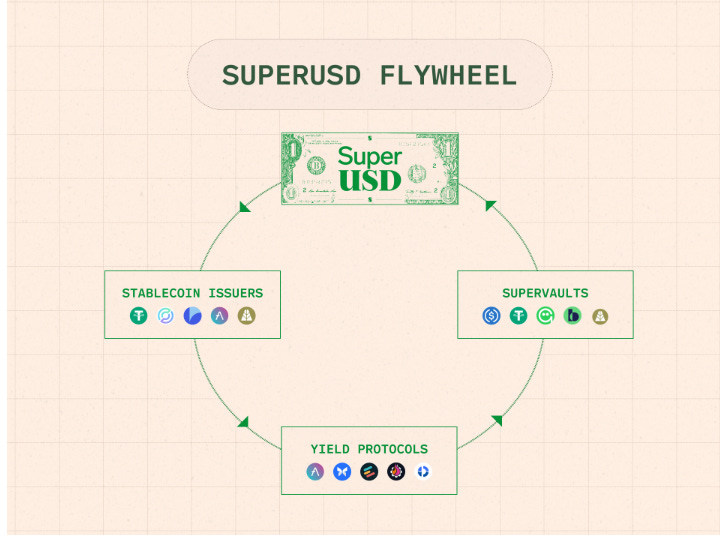

Superform’s USDC Fixed Yield leverages Pendle’s Principal Tokens (PTs) to separate future yield from principal value. When you deposit USDC into Superform, it gets converted into PT-SuperUSDC, which you acquire at a discount (e.g., buying at $0.90 per USDC). At maturity, PT-SuperUSDC is redeemable 1:1 for USDC, meaning you lock in a guaranteed return simply by holding until maturity.

This approach eliminates APY fluctuations—unlike staking or yield farming, where your rewards are dependent on market-driven interest rates. Instead, your yield is defined at the time of purchase, ensuring predictability in an otherwise volatile DeFi environment.

Key advantages over traditional yield strategies

Guaranteed Fixed Returns Without Variable Yield Exposure

Unlike staking or lending protocols like Aave, where yield fluctuates based on utilization rates, PT tokens ensure a pre-determined yield outcome.

The underlying yield from the base asset is instead diverted to Yield Token (YT) holders, who take on variable yield exposure.

No Impermanent Loss, No Volatility Risk

Since your investment remains in USDC, there’s zero price risk associated with market downturns.

This makes it superior to traditional LP farming, where impermanent loss can erode returns.

Instant Withdrawals, No Lockups

Unlike staking models, which often require bonding periods or cooldowns, Superform allows for immediate redemption at the market price.

While early exits may involve selling PT tokens at a discount, the presence of a secondary market on Pendle mitigates liquidity concerns.

Enhanced Security Through Smart Contract Audits

Audited by yAudit and backed by Pendle’s battle-tested smart contracts, this strategy ranks among the safest DeFi yield options available.

The risk score of 95 (low risk) reflects its robustness and simplicity.

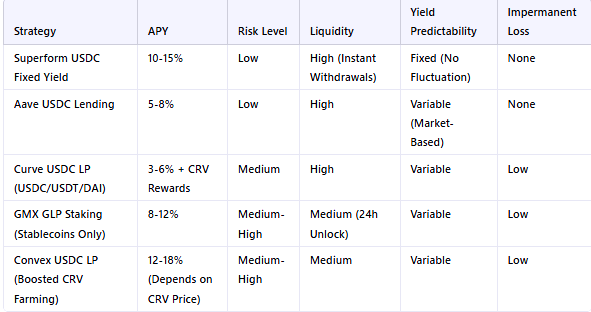

Let’s compare Superform USDC fixed yield to other Ethereum yield strategies

From this breakdown, it’s clear that Superform’s fixed yield strategy outperforms lending protocols like Aave in terms of yield while offering greater stability than LP farming or DeFi derivatives.

Who Should Use Superform USDC Fixed Yield?

Institutional DeFi Investors: Those looking for fixed-yield alternatives that eliminate interest rate volatility.

Stablecoin Yield Maximizers: Investors who want higher returns than lending without exposure to market-driven APY fluctuations.

Risk-Averse Yield Seekers: Those who prefer a guaranteed return with instant liquidity over riskier LP farming strategies.

Consider joining our Premium community today

Our 2025 focus: To Participate in 100% of major airdrops/testnets and identify Defi/gems early and support early phase career participation in crypto.

What to expect:

👉 Every Monday: Ecosystem/Mainnet/funding updates, Defi Yield farming, Staking Airdrops, Research/reports, ICO/IDO?Presales and Crypto trading opportunties

👉 Every Thursday: Protocol Spotlights, with in-depth analysis of 2-5 select protocols or tokens, and yield farm opportunities.

N/B:

Free Subscribers: Have access to 20% of the content as an overview

Paid Subscribers: Have access to 100% of the contents and community features like chat room (10x alphas are shared on the chat room) etc