Welcome to another edition of Cryptofada research. For partnership, email- cryptofadainfo@gmail.com.

OUTLINE: Category of Crypto-based companies in

1. Crypto Exchanges

2. Bitcoin Holders

3. Bitcoin Miners

4. Payment Processors

5. Financial Services

6. Technology Providers

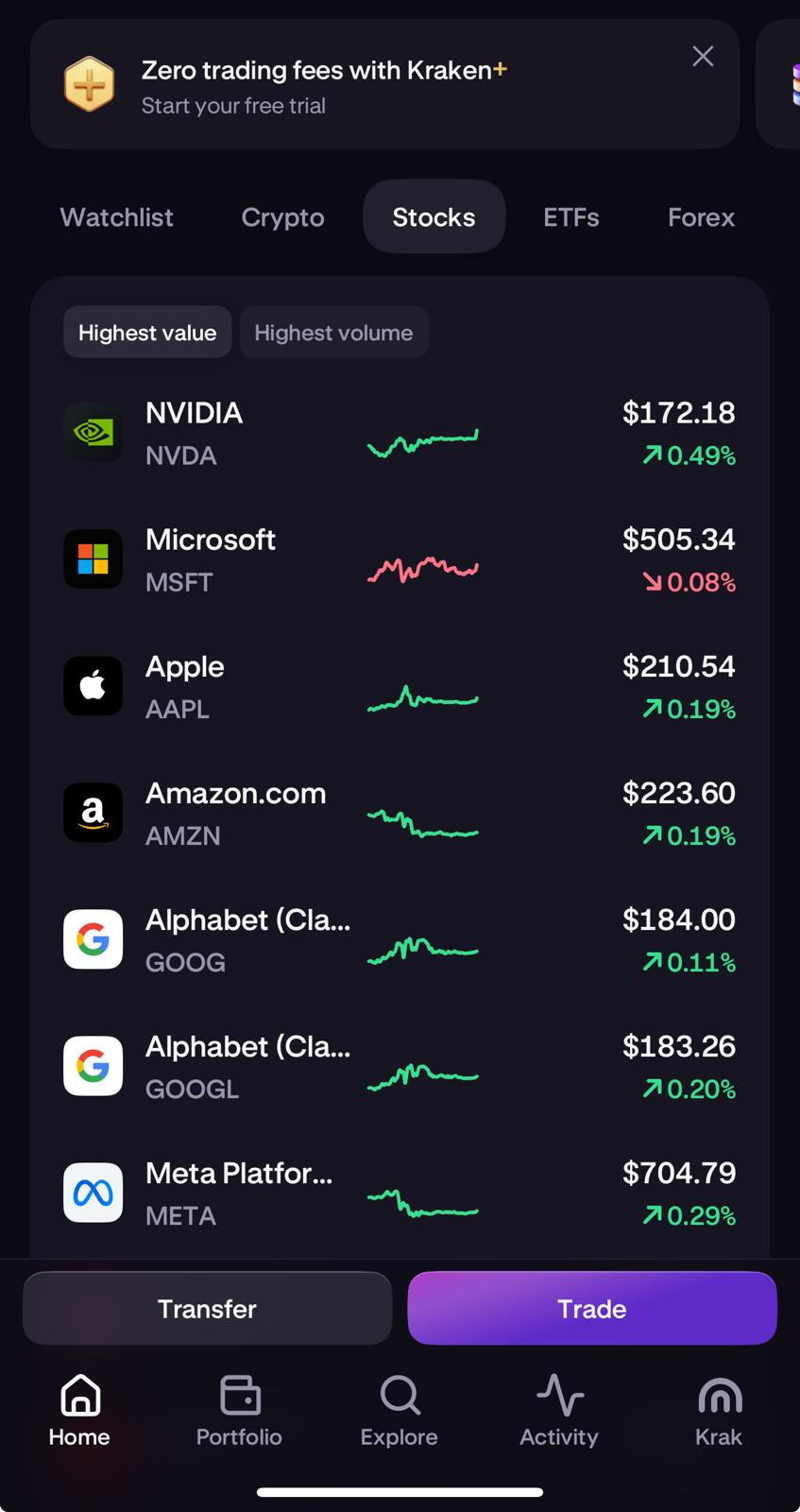

7. OthersToday, I will be sharing some of the top crypto-based company I wish you would consider checking out or buying from the stock exchange. Also remember, you can buy them now on the blockchain 24/7 unlike the Tradfi that awaits the open bell. You can buy stocks directly from Kraken without a stockbroker anytime.

If you use my referral code or link to try it, we’ll both earn $75 when you trade $200 of crypto in the app!

Code: qfhr35w7

Link: Cryptofada free stocks

Strategic Considerations before choosing a crypto-based stock

Given the complexity and volatility of the crypto market, investors should consider the following strategies:

Diversification: Research suggests allocating no more than 5-10% of your portfolio to crypto stocks, as advised by financial planner Malcolm Ethridge, to mitigate risks. Combine direct plays (e.g., COIN, MSTR) with indirect exposure (e.g., NVDA, V) for balance.

Risk Management: Focus on companies with strong balance sheets (e.g., COIN, BLK) or diversified business models (e.g., SQ, PYPL) to reduce crypto-specific risks. Monitor high Beta stocks like COIN (3.62) for volatility.

Regulatory Outlook: The evidence leans toward significant regulatory developments, especially during U.S. "Crypto Week" starting July 14, 2025, which could impact market sentiment and stock performance. Stay informed on legislative changes.

Bitcoin Price Correlation: Stocks like MSTR, MARA, and RIOT are highly correlated with Bitcoin's price, currently at $118,760.39 (7/16/2025). A rally to $120,000-$200,000 could drive significant upside, but volatility remains a key risk.

ETFs for Simplicity: For risk-averse investors, consider ETFs like Global X Blockchain ETF (BKCH), with an expense ratio of 0.50%, offering diversified exposure to 25 blockchain-related stocks, including COIN and MARA. ETF Database

The stocks were selected based on the following criteria:

Crypto Exposure: Companies with direct or indirect exposure to cryptocurrencies or blockchain technology, such as exchanges, miners, payment processors, or those with significant crypto holdings.

Market Capitalization: Companies listed on major U.S. exchanges (Nasdaq or NYSE) with a market cap of at least $1 billion to ensure liquidity and stability.

Analyst Ratings: Consensus analyst ratings of “Buy” or better, with at least 12% upside potential based on average 12-month price targets.

Financial Performance: Strong revenue growth, profitability, or potential for future earnings based on recent quarterly reports.

Industry Trends: Alignment with blockchain adoption trends, such as institutional investment, decentralized finance (DeFi), or regulatory developments.

Risk Profile: Consideration of volatility, regulatory risks, and operational challenges specific to the crypto sector.

Data is current as of July 16, 2025, reflecting the latest market conditions, including Bitcoin's price of $118,760.39 and ongoing legislative discussions during "Crypto Week" starting July 14, 2025.

Detailed Analysis by Category

Crypto Exchanges

This category includes companies that operate platforms for trading and custody of cryptocurrencies, benefiting from increased trading volumes and institutional adoption.

Coinbase Global, Inc. (COIN):

Financial Metrics: Market Cap: $100.36B, Stock Price: $405.88 (intraday high, 7/15/2025), Trailing P/E: 72.94, Forward P/E: 72.46, Price/Sales (ttm): 15.52, Profit Margin: 22.03%, Revenue (ttm): $6.67B, Net Income (ttm): $1.47B, Beta: 3.62.

Market Positioning: Largest U.S.-based crypto exchange with over 108 million verified users and $1.7 trillion in annualized trading volume. Offers trading, custody, and institutional services, founded in 2012, based in New York, NY, with 3,772 full-time employees.

Growth Potential: YTD Return: 60.37% vs. S&P 500's 6.50%, 1-Year Return: 58.34%, 3-Year Return: 640.29%, Earnings Date: Jul 31, 2025, Analyst Target: $290.82.

Risks: High valuation (P/E ~73x), regulatory risks in the U.S., and dependency on crypto market sentiment, with a high Beta indicating volatility.

Why Invest: Dominant player with global reach and institutional partnerships, ideal for direct crypto exposure. Yahoo Finance

Bitcoin Holders

These companies hold significant amounts of Bitcoin on their balance sheets, offering a direct play on Bitcoin's price appreciation.

MicroStrategy Inc. (MSTR):

Financial Metrics: Market Cap: $107B, Stock Price: $1,800, Holds 478,740 BTC ($46.6B as of Feb 2025), Plans to raise $42B for further acquisitions (2024-2027), 12-month performance: 181%.

Market Positioning: Rebranded as "Strategy," essentially a Bitcoin treasury company, with a diversified enterprise software business for stability.

Growth Potential: Strong upside if Bitcoin reaches $120,000-$200,000, given its aggressive acquisition strategy.

Risks: Heavy reliance on Bitcoin price; leverage from loans increases financial risk, with potential for significant losses if BTC declines.

Why Invest: Pure play on Bitcoin's appreciation with additional software revenue. Motley Fool

Bitcoin Miners

Bitcoin mining companies validate transactions and earn rewards, with performance tied to Bitcoin prices, energy costs, and mining efficiency.

MARA Holdings, Inc. (MARA):

Financial Metrics: Market Cap: $5B, Stock Price: $14.98, Hashrate: 36.9 EH/s (Q3 2024), Bitcoin Production: 2,070 BTC (Q3 2024), Revenue: $132M (+35% YoY, Q3 2024).

To read beyond this point, please consider supporting us at Cryptofada Newsletter

With just $2 weekly, you will support the newsletter and access 100% of the Defi/Crypto opportunities we share at least twice weekly:

What to expect:

👉 Every Monday: Ecosystem/Mainnet/funding updates, Defi Yield farming, Staking Airdrops, Research/reports, ICO/IDO/Presales and Crypto Jobs and trading opportunities

👉 Every Thursday: Protocol Spotlights, with in-depth analysis of 2-5 select protocols or tokens, and yield farm opportunities.

N/B:

Free Subscribers: Have access to 20% of the content as an overview

Paid Subscribers: Have access to 100% of the contents and community features like chat room (10x alphas are shared on the chat room) etc

Keep reading with a 7-day free trial

Subscribe to Cryptofada Research to keep reading this post and get 7 days of free access to the full post archives.