Less popular Defi opportunities on SOLANA you should explore today

If this makes sense, please consider sharing

Hi

Normally I would wait till Monday, but I feel like by Monday this opportunities will be saturated. We will still have curated defi on Monday but take time and participate in the underlisted.

Defi opportunities on SOLANA

Using ZEC as a DeFi Collateral: How to Borrow/Lend on Loopscale with zenZEC

Zcash’s core promise has always been clear: true financial freedom needs privacy. For the first time, ZEC holders can now access that privacy while tapping into high-speed DeFi. With zenZEC on Solana and newly activated collateral support on Loopscale, ZEC finally enters the world of borrowing, lending, liquidity, and on-chain rewards—without compromising its original ethos.

zenZEC is a fully backed 1:1 wrapped ZEC secured by Zenrock’s decentralized custody (dMPC) and issued on Solana. Since launching on October 31, it has already gained serious momentum: $30M+ in volume, 1.4k holders, 1k zenZEC minted, and 200k trades. Incentives are robust as well, with 1M ROCK tokens, 3x Loopscale points, and equal rewards across all core activities. For DeFi investors, this marks a major unlock: ZEC is finally interoperable, yield-ready, and accessible across Solana’s fastest lanes.

Most people do not know about $ORE and others just glance at it trading at over $100 and instantly think it’s “expensive.” They compare it to $SOL and walk away—but that’s exactly why they’re missing the alpha.

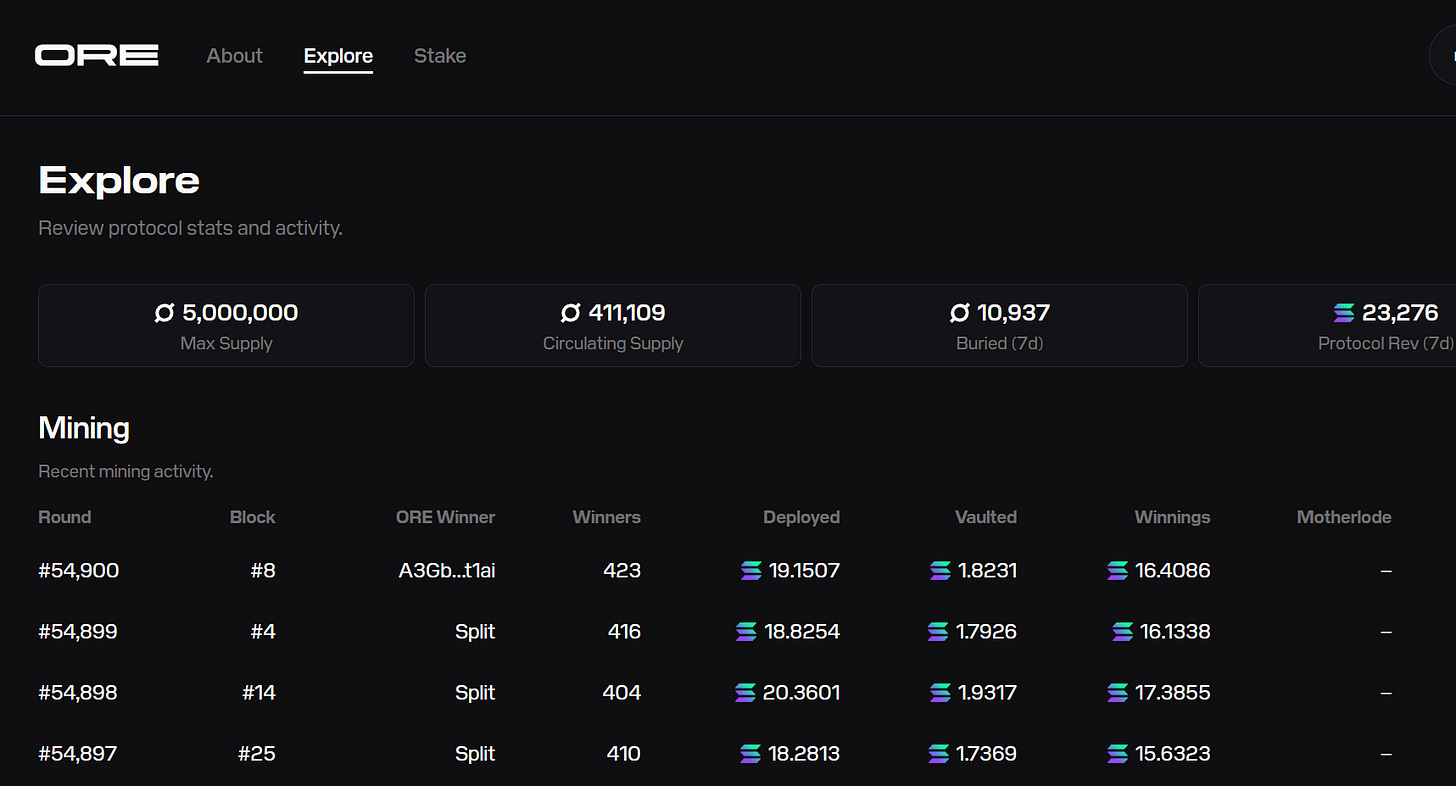

ORE isn’t a typical token. Check the picture attached:

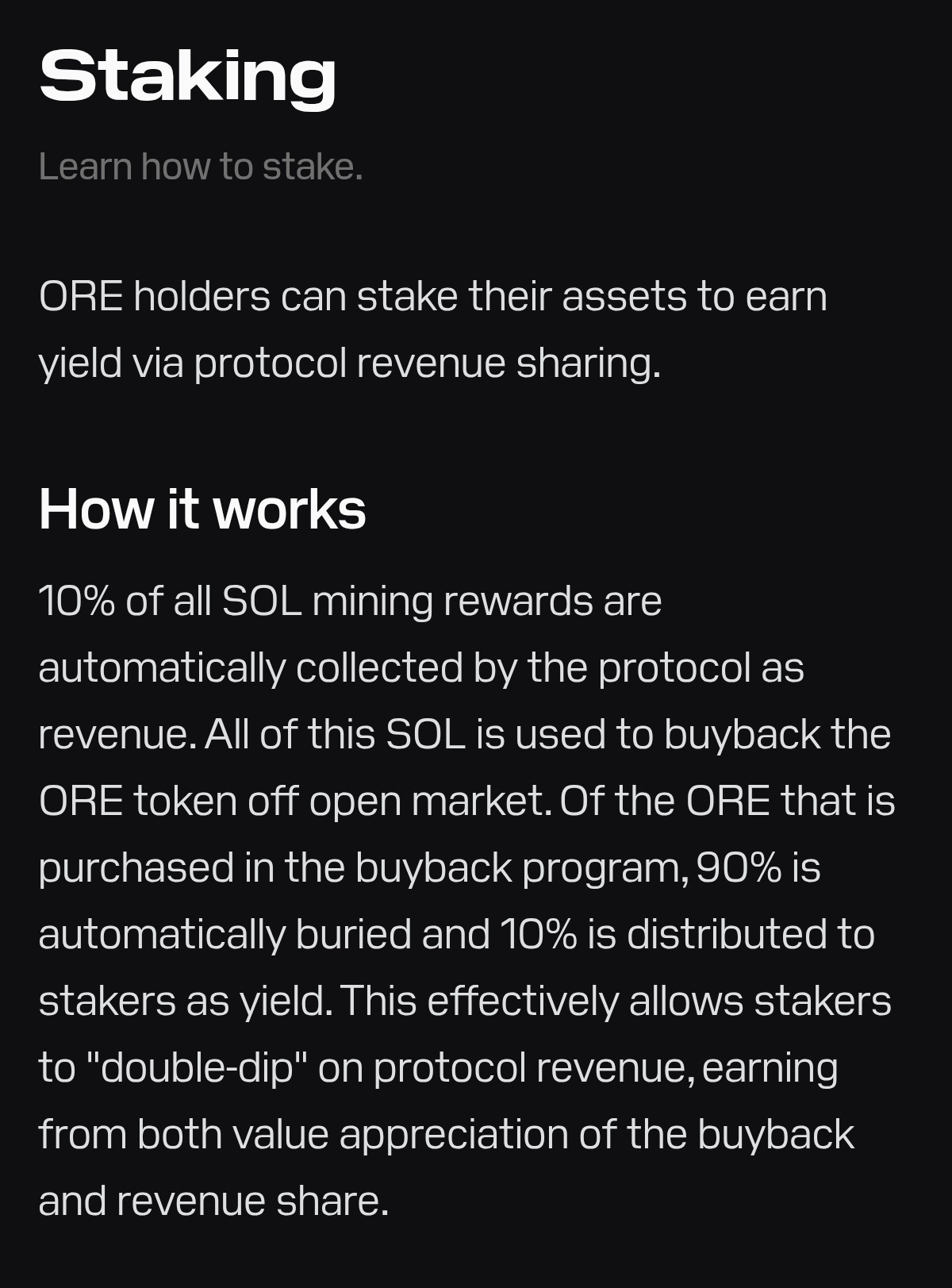

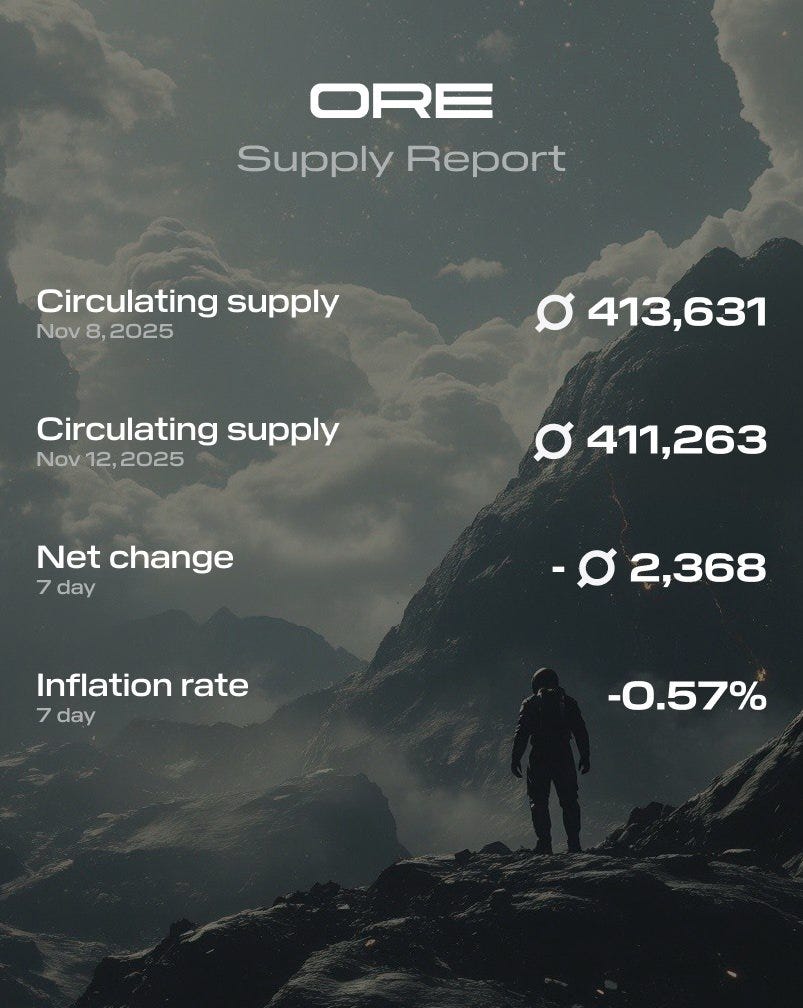

in 7 days have generated over $3.5M. Circulating supply is under 500k, and issuance is fixed at just 1 ORE per minute. More than half of all mined ORE is already staked, meaning the majority of supply is locked, not sold. On top of that, ORE’s revenue engine is printing about millions per day, and every dollar feeds continuous buybacks—90% is permanently removed from supply, while 10% flows directly to stakers.

When you combine ultra-tight supply, slow emissions, high staking participation, and daily buybacks, you get a token with built-in upward pressure as long as Solana stays relevant. Forget current cost looking expensive—at these fundamentals, even $2,000 looks cheap. Three months from now, today’s prices will feel like a blessing. This is real economic rocket fuel. Don’t sleep on ORE.

ORE mining involves deploying SOL tokens to claim squares on a 5×5 grid. The winning square is determined by on-chain randomness, and rewards are distributed proportionally based on your SOL deployment relative to all miners on that square

The following are some mining strategies you might be interested in (click here for details):

1. Diversification Strategy

Principle: Spread your SOL across multiple squares to reduce risk and increase the probability of winning.

2. High-Value Square Strategy

Principle: Target squares that already have high SOL deployments, assuming they attract more miners and may indicate “popular” or “strategic” positions.

3. Low-Competition Strategy

Principle: Target squares with low SOL deployments to maximize your reward share if those square wins.

4. Average-Following Strategy

Principle: Target squares with SOL deployments close to the round average, balancing competition and reward share.

5. ROI-Based Strategy

Principle: Calculate expected return on investment (ROI) for each square and deploy to squares with the highest expected value.

A final thought, ORE’s supply is deflationary

The ORE tokenomics are fasinating when you actually lok at the numbers. Under 500k circulating supply with fixed issuance of 1 per minute, plus over half already staked, means the float is incredibley tight. The buyback mechanisim with 90% permanent removal is basicaly deflationary by design. If Solana stays strong, this could easilly be a hidden gem most poeple will regret sleeping on.