How to earn 83% plus effective APY by Staking Solana via iA

Airdrops, Yields and strategies plus research

Welcome to another edition of Cryptofada research. For partnership, email- cryptofadainfo@gmail.com.

Kindly show love by sharing the newsletter with others

Follow my Defi Challenge: 2 SOL ($300) to 100 SOL ($15,000 using $150/SOL as Solana price benchmark)

I’m currently on an experiment to convert 2 SOL into 100 SOL. You can Join me in the challenge (I can show you how for free) or you follow the progress on my twitter (@Cryptofada) or Substack notes.

Disclaimer: I only use less risky strategies for capital preservation but benefit from wild volatility in low cap tokens. Also, I have been in Defi/crypto for a while and I’m only sharing some of the things I am learning so this is NOT a financial advice

OUTLINE:

1. Crypto ecosystem updates

2. Research, Reports & Insights

3. Crypto/Defi/web3 Jobs

4. The best Defi/Yield Farming opportunities

i)Low risk yields

ii)Medium risk yields

iii)High risk yields

iv) Others:

-LST Strategies with Kofi Finance on Aptos

-Turning ETH into USDA+ Yield (Simple, Step-by-Step) on Autonomint

-How to earn 83% plus effective APY on Staking Solana via iA

-Top 3 Promising Blockchains Flying Under the Radar

5. Airdrops/TestnetsCrypto/Defi ecosystem updates

MetaMask set to launch mUSD stablecoin on Ethereum and Linea, issued by Stripe-owned Bridge. MetaMask USD ($mUSD) is the first native stablecoin launched by a self-custodial wallet, fully integrated into MetaMask’s ecosystem across dapps and DeFi protocols

Grvt becomes first on-chain exchange to pay retail traders for making markets. Placing limit orders on Grvt actually earns you a rebate. Instead of paying fees, you get −0.01% back when your maker orders fill. Basically, retail finally gets access to the same perks that big institutions have had forever.

Stargate DAO Approves LayerZero’s Proposal to Acquire Stargate (STG). The proposal saw strong participation, more than 15,000 voters, voting with over 7.5M veSTG.

Football.Fun: Onchain Fantasy Football Game That Lets You Own & Trade Your Favorite Players. it’s Built fully onchain using Base. Buy player shares, build your dream squad, play in tournaments, and win packs + rewards.

Trepa Raises $420K in a Pre-Seed Round Led by Colosseum. Trepa is a prediction platform that pays you for precision and accuracy unlike traditional prediction markets that give you no upside for accuracy

MetaMask x Aave Integration Surpasses $100M in Deposits

SharpLink Approves SBET Buyback, SharpLink Gaming’s Board approved a $1.5 billion stock repurchase program. The move gives the company flexibility to act when SBET trades at or below NAV of its ETH holdings, helping prevent dilution on its ETH per share basis and enhancing long-term value for shareholders.

Agglayer introduces CDK Enterprise, a Financial-grade Privacy the Meets Native Interop for Custom Blockchains. CDK Enterprise is designed to break this deadlock. Enterprises no longer have to choose between privacy, performance, and cost. They can have it all.

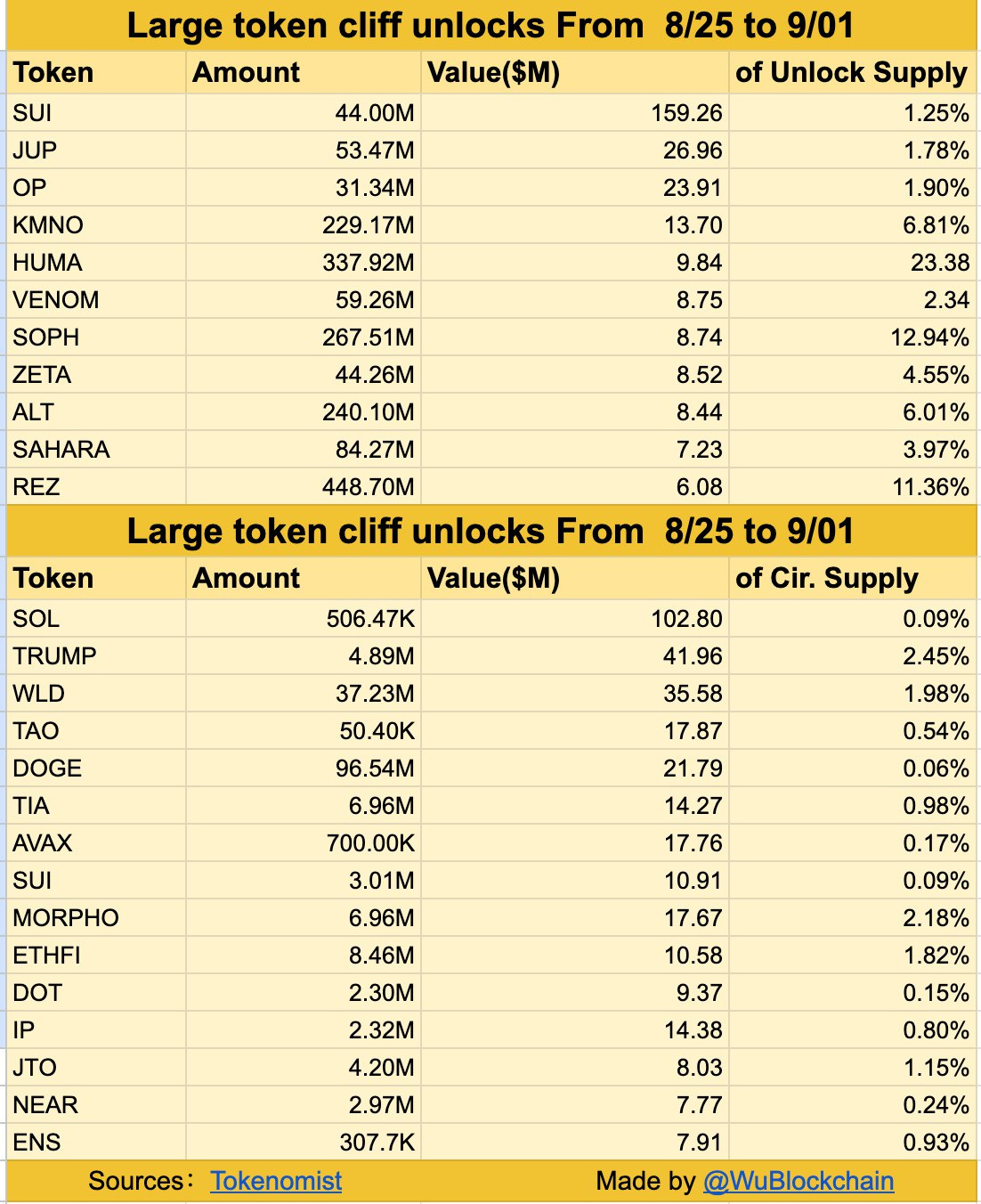

Tokens unlock:

Research, Reports & Insights

In simple terms, the article argues that Pendle’s YT/PT system on Kinetiq is a massive overlooked opportunity that only whales seem to fully grasp. By splitting HYPE into PT (Principal Tokens), which act like buying HYPE at a discount with steady returns, and YT (Yield Tokens), which give leveraged yield and huge kPoint multipliers, investors can either play it safe or go degen for outsized rewards. While PTs lock in predictable ~30–35% APY through looping, YTs offer insane exposure—turning small amounts of HYPE into 30–40x more points and yield, which could translate into triple-digit ROIs if kPoints are valued highly in future airdrops. The key insight is that small wallets often earn more points per YT than big wallets, meaning the opportunity is arguably better for retail than whales. Despite some uncertainty in point calculations and dependence on Kinetiq’s long-term success, the data shows that stacking YTs for points now could be one of the most asymmetric bets in DeFi.

Jump Crypto: Dual Flow Batch Auction

Jump Crypto’s newly proposed “Dual Flow Batch Auction” (DFBA) is reimagining on-chain trading by batching orders into two separate auctions—one for makers, one for takers—every ~100 milliseconds. This structure removes the traditional time-priority rush, shifting the competitive edge toward better price and size rather than speed, which helps curb latency arbitrage and MEV issues while encouraging tighter spreads and deeper liquidity.How to Finance Supercomputers with USD.AI

Leviathan News has highlighted a fresh vision with USD.AI, a yield-bearing stablecoin backed by AI compute power—an innovation that enables on-chain users to invest in and finance supercomputer infrastructure, unlocking scalable, double-digit returns.RedStone: Hyperliquid Report—HyperEVM, HIP-3, HyperCore & Full Ecosystem Overview

RedStone’s latest report reveals that Hyperliquid—a lean, self-funded decentralized perpetuals exchange—is dominating the on-chain perps market with over 80% share and ~$30 billion daily volume. Its success stems from a centralized-speed on-chain order book, the permissionless HIP-3 framework encouraging developer-driven growth, and an innovative dual-layer architecture (HyperCore plus HyperEVM) that enables tokenized perp positions and sophisticated trading strategies.

Crypto Jobs

Investment Analyst (Liquid Token) at Re7 Capital

Design - Senior Web - Solidity Engineer (EVM) - Rust Engineer (Solana) - Risk Analyst - Security Analyst - Marketing needed at jobs@flyingtulip.com

DeFi Yield Analyst at Re7 Capital

Twitter/X Manager at CoinTerminalCom

Staff SRE & Defi Scalability Lead at Reserve protocol

Project Lead (Head of Development) at Blockbyte

DeFi Trade and Investment Operations Associate at Avantgarde

Customer support agent at wert_io

Protocol Growth Lead at Avara

Protocol Strategist at Gauntlet

The best Defi/Yield Farming opportunities

Stablecoin Markets

High Risk Market

To read further please consider supporting us at Cryptofada Newsletter

With just $2 weekly, you will support the newsletter and access 100% of the Defi/Crypto opportunities we share at least twice weekly:

What to expect:

👉 Every Monday: Ecosystem/Mainnet/funding updates, Defi Yield farming, Staking Airdrops, Research/reports, ICO/IDO/Presales and Crypto Jobs and trading opportunities

👉 Every Thursday: Protocol Spotlights, with in-depth analysis of 2-5 select protocols or tokens, and yield farm opportunities.

N/B:

Free Subscribers: Have access to 20% of the content as an overview

Paid Subscribers: Have access to 100% of the contents and community features like chat room (10x alphas are shared on the chat room) etc

Keep reading with a 7-day free trial

Subscribe to Cryptofada Research to keep reading this post and get 7 days of free access to the full post archives.