Defi ecosystem & Yield updates

Airdrop & Testnets

Welcome to another edition of Cryptofada research. For partnership, email- cryptofadainfo@gmail.com.

My Fun Game: I’m currently on an experiment to convert 0.3 SOL into 100 SOL . You can Join me in the challenge (I can show you how for free) or you follow the progress on my twitter (@Cryptofada) or Substack notes.

I only use less risky strategies for capital preservation but benefit from wild volatility in low cap tokens. Also, I have been in Defi/crypto for a while and only I’m only sharing some of the things I am learning so this is NOT a financial advice

OUTLINE:

1. Crypto ecosystem updates

2. Research, Reports & Insights

3. Crypto Web3 Jobs

4. Best Defi/Yield farming weekly

i)Low risk yields

ii)Medium risk yields

iii)High risk yields

5. Airdrops/TestnetsCrypto/Defi ecosystem updates

Plasma Testnet Launch

Plasma launched its testnet, introducing a stablecoin-focused Layer 1 designed for high-throughput global payments. Key features include PlasmaBFT consensus, EVM compatibility, zero-fee USD₮ transfers, support for custom gas tokens, and a native Bitcoin bridge. Developers can access documentation and begin building today.

Boundless Mainnet Beta on Base

Boundless has launched its Mainnet Beta on Base and introduced The Signal, a ZK consensus client enabling any chain to verify Ethereum state. Backed by Base, Wormhole, EigenLayer, and others, The Signal aims to bring universal ZK interoperability across chains.

Cashmere Labs Public Devnet Launch

Cashmere Labs has launched its public devnet, enabling instant, one-click, zero-slippage cross-chain transfers across Ethereum Sepolia, Avalanche Fuji, Solana Devnet, Aptos, and Sui testnets. Users can set up their .csm domain, use testnet faucets, lock NFTs for multipliers, and begin transferring without needing to complete quests. The team plans to launch the mainnet app shortly after devnet concludes, with audits underway during this phase.

Jupiter Launches JLP Loans

Jupiter launched JLP Loans, allowing users to borrow USDC against JLP while still earning yield. The overcollateralized loans (up to 86% LTV) aim to unlock idle USDC in the pool and create a new yield stream for LPs, starting with tight risk controls and USDC-only borrowing.

Nerite Launches on Arbitrum with $USND

Nerite has launched on Arbitrum with $USND, a fully backed and overcollateralized stablecoin streamable via Superfluid. Users can mint USND by borrowing against assets like ETH, wstETH, tBTC, and more. Liquidity is live on Bunni and Camelot, with integrations including Teller (fixed loans), Gearbox (rehypothecation), and upcoming position managers. The protocol uses API3 oracles, Octane for CI-based security scanning, and Aragon for governance. NERI (not live yet) will serve as the future governance token.

Euler Goes Live on Telegram

Euler is now live on Telegram via TacBuild, enabling lending and borrowing directly through @EulerFinanceBot with $300K TAC and $100K rEUL incentives. Supported assets include TON, WETH, cbBTC, tsTON, LBTC, wstETH, and USDT.

U.S. House Passes GENIUS Act

The U.S. House passed the GENIUS Act, a landmark bill establishing a regulatory framework for stablecoins, sending it to President Trump for signature. Backed by bipartisan support (308–122), the bill would expand CFTC oversight and offer consumer protections for USD-pegged digital assets. It marks a key win for the crypto industry during Trump's "Crypto Week" initiative, as lawmakers aim to make the U.S. a global crypto leader.

ReyaChain - First Trading-Focused Base Rollup

ReyaChain has launched as the first trading-focused based rollup, aiming to unify DeFi, TradFi, and CeFi into a decentralized capital market infrastructure. The chain features embedded perp DEXs, deep liquidity, gasless MEV-free trades, and a CLOB with millisecond execution. Users can trade anything with anything as collateral, positioning Reya as the decentralized Nasdaq on Ethereum. ReyaChain Points (RCP) also reward traders, stakers, and ecosystem contributors.

Project X Launches HyperEVM DEX (Official Site | Decrypt Coverage)

Project X has officially launched, introducing a new HyperEVM DEX as the first step in a multi-phase rollout. The protocol aims to unify trading across all EVM chains and HyperCore, with future plans to add an EVM aggregator and further undisclosed features. Users can earn points by trading, providing liquidity, or inviting friends—1 million points are distributed daily. The platform is self-funded with no VC backing.

Catex Launches on Unichain

Catex has launched on Unichain as a MetaLayer of Uniswap v4, combining ve(3,3) governance, hook innovation, and automated liquidity management. The platform enables LPs to earn, hook developers to deploy strategies, and aligns incentives within a unified framework.

Ramses Expands to HyperEVM (Official Docs | Exchange Site)

Ramses has expanded to HyperEVM, bringing its x(3,3) mechanics from Ramses V3—including liquid, non-vesting emissions and RAM-to-xRAM conversions that reduce FDV. The launch features built-in JIT defense at the contract level, an RXP points system for early user rewards, and r33 for liquid xRAM staking. Emissions are live from day one, and all RAM converted to xRAM is burned.

Curve Launches on TON

Curve has launched on TON via a Telegram mini app, offering users a mobile-first DeFi experience directly through @CurveAppBot. Users can now swap assets, provide liquidity, and earn yield with minimal slippage—all within the Telegram interface.

Kinetiq Launches kHYPE on Hyperliquid

Kinetiq has launched on Hyperliquid mainnet with kHYPE, a liquid staking token for HYPE. Users can stake HYPE for kHYPE instantly, earn staking rewards, and use it across platforms like Veda, Felix, and Curve. kPoints are live, with weekly snapshots and rewards. Audits by Spearbit and others have been published.

Russia’s Largest State-owned Bank Sberbank Plans to Provide Custody Services for Domestic Crypto Assets

Sberbank, Russia’s largest state-owned bank, plans to offer custody services for domestic crypto assets and has submitted proposals to the central bank to support this move. The initiative aims to secure users’ tokens and integrate crypto assets into a regulated system similar to traditional banking. This follows a recent shift in the Russian central bank's stance, which now permits the use of cryptocurrencies in international trade amid Western sanctions.

El Salvador hasn't bought Bitcoin since February, finance chiefs tell IMF, contradicting Bukele administration

The IMF's latest report says El Salvador hasn’t bought Bitcoin since February 2025, citing a letter from top officials. It notes recent reserve increases came from internal wallet consolidation, not new purchases—contradicting President Bukele’s claims of daily 1 BTC buys

$KAITO - Kaito is expected to make a big announcement next week

Kaito, an AI-powered InfoFi platform that rewards users for sharing crypto insights, is anticipated to unveil a significant announcement during the week of July 20, 2025, potentially impacting its $1.67 USD token price and market cap of over $403 million, as reported by CoinMarketCap. The platform, which incentivizes user engagement through its Yap-to-Earn model and has seen a 60% price surge post-airdrop earlier in 2025, may reveal updates related to new features, partnerships, or tokenomics, further boosting its prominence in the Web3 ecosystem. Investors and community members are closely watching for details, given Kaito’s integration with major exchanges like Binance and its high 53.6% APR staking rewards.

$BTC - Trump administration is rumored to release a BTC reserve funding plan on July 22

Rumors are circulating that the Trump administration may announce a Bitcoin reserve funding plan on July 22, 2025, as part of its broader pro-crypto agenda, following earlier moves to establish a strategic crypto reserve including Bitcoin, Solana, and XRP. This speculative plan, unconfirmed by official government sources, has sparked debate within the crypto community, with some industry leaders like Coinbase CEO Brian Armstrong advocating for Bitcoin-only reserves, while others warn of potential market volatility and risks to taxpayers if altcoins are included. The proposal aligns with Trump’s promise to make the U.S. a “crypto capital,” but its details and feasibility remain uncertain, requiring official confirmation.

$S - The claiming portal for Sonic S1 airdrop will open in the next 2 days

Sonic Labs is set to open its Sonic Season 1 (S1) airdrop claiming portal within two days from July 21, 2025, allowing eligible users to redeem 25% of their $S token allocations, with the remaining 75% vesting as NFTs over 270 days. Announced by co-founder Andre Cronje, this airdrop follows Sonic’s AI-powered product enhancements and aims to enhance user experience on its blockchain, with the claim date initially set for July 17 but reportedly delayed. The event is expected to generate significant interest, though U.S. residents’ eligibility adds a layer of complexity amidst regulatory scrutiny.

Infinex - Infinex will soon release a lot of new features for its crypto everything app, including a browser extension

Infinex, a comprehensive crypto platform, is poised to launch a suite of new features for its “crypto everything app,” including a browser extension to enhance user accessibility and interaction with decentralized finance (DeFi) and blockchain services. This update, expected soon after July 21, 2025, aims to bolster Infinex’s ecosystem by integrating support for networks like Avalanche, building on its reputation for seamless user experiences. The announcement has garnered attention for its potential to drive adoption, though specific release dates and feature details remain forthcoming, pending official confirmation from Infinex.

$OP - Optimism will undergo a Superchain Upgrade next week

Optimism, a leading Ethereum Layer 2 scaling solution, is scheduled to undergo a Superchain Upgrade during the week of July 20, 2025, aimed at enhancing its blockchain’s scalability, interoperability, and efficiency within the Superchain ecosystem. This upgrade is expected to improve transaction speeds and reduce costs, reinforcing Optimism’s role in DeFi and decentralized applications. The crypto community is optimistic about the potential market impact on the $OP token, though specific technical details and exact timing are yet to be fully disclosed by the Optimism team.

Lombard - Lombard will upgrade LBTC to a yield-bearing BTC asset on July 22

On July 22, 2025, Lombard is set to upgrade its LBTC (Liquid Bitcoin) to a yield-bearing asset, enabling holders to earn returns on their Bitcoin holdings within its ecosystem. This upgrade aims to enhance the utility of LBTC, positioning it as a competitive option in the DeFi space by offering passive income opportunities. The move is expected to attract investors seeking yield-generating crypto assets, though further details on the yield structure and implementation are awaited from Lombard’s official channels.

$AVAX - Next deadline for VanEck's spot Avalanche ETF application is July 28

VanEck’s application for a spot Avalanche ($AVAX) ETF faces a critical deadline on July 28, 2025, as the SEC reviews its proposal to offer investors exposure to the Avalanche blockchain’s native token, known for its high-throughput and low-latency capabilities. This follows VanEck’s efforts to expand its crypto ETF portfolio, with the outcome potentially influencing $AVAX’s market dynamics and institutional adoption. The crypto community is closely monitoring the SEC’s decision, given the growing interest in altcoin ETFs.

$JUP - Jupiter teased a major announcement for next week

Jupiter, a prominent decentralized exchange aggregator on the Solana blockchain, has teased a major announcement for the week of July 20, 2025, potentially involving new features, partnerships, or governance updates for its $JUP token. Known for its high trading volume and user-friendly interface, Jupiter’s upcoming reveal is generating significant buzz among Solana ecosystem participants, though specifics remain undisclosed, fueling speculation about its impact on the token’s market performance.

$COIN - Coinbase will launch US Perpetual-Style Futures on July 21

On July 21, 2025, Coinbase, a leading cryptocurrency exchange, is launching US Perpetual-Style Futures, expanding its derivatives offerings to provide traders with new tools for leveraging Bitcoin and other assets. This move aligns with Coinbase’s ongoing efforts to integrate advanced trading features and capitalize on the growing demand for crypto derivatives, potentially boosting its platform’s trading volume and $COIN stock value. The launch is expected to enhance market liquidity and attract institutional investors.

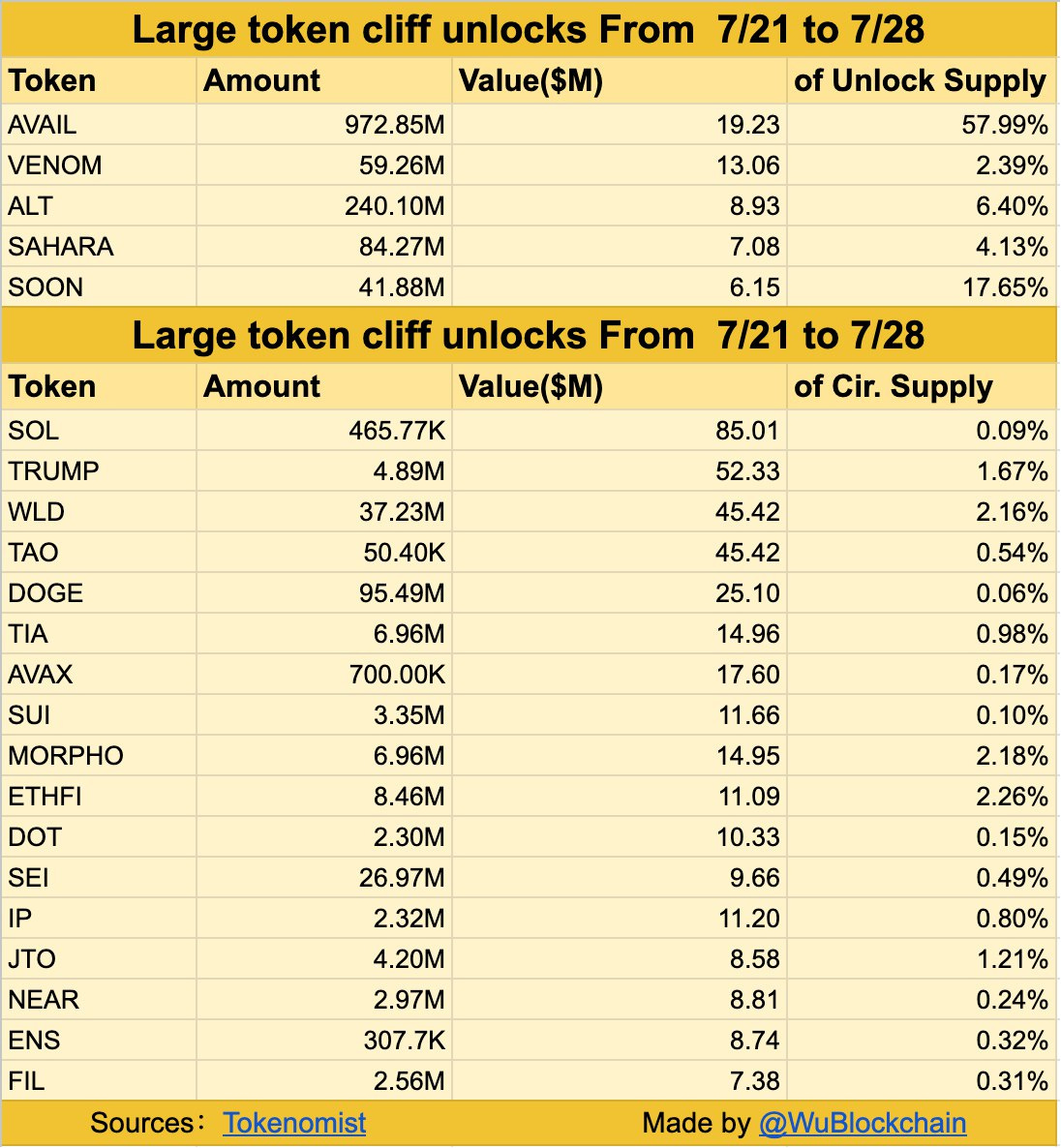

$ZRO - ~23% of LayerZero's ZRO circulating supply will be unlocked today

Approximately 23% of LayerZero’s $ZRO token circulating supply is reportedly set to unlock on July 21, 2025, potentially increasing market liquidity and impacting the token’s price, which supports LayerZero’s cross-chain interoperability protocol. However, no direct source confirms this specific unlock date, making it critical to verify through LayerZero’s official announcements or platforms like CoinGecko. The unlock could lead to short-term volatility as holders decide whether to sell or hold, affecting LayerZero’s market dynamics.

Research, Reports & Insights

The crypto market rebounded strongly in Q2 2025, with total market capitalization climbing 24% to $3.5 trillion—nearly recovering all early-year losses. Bitcoin led the rally, surpassing $100,000 and driving its dominance to over 62%, while Circle’s massively oversubscribed IPO reignited institutional interest. However, despite the bullish price action, spot trading volume on centralized exchanges dropped by 27.7%, revealing weakening engagement in traditional venues. Ethereum posted gains but remained below its 2025 starting price, and altcoins broadly underperformed in the shadow of Bitcoin’s surge.

Amid these shifts, trading dynamics continued to evolve. Decentralized exchanges (DEXs) saw explosive growth, with PancakeSwap and Hyperliquid capturing significant market share in both spot and perpetual trading. Spot volume on DEXs rose 25.3% quarter-over-quarter, reaching a new record high in the DEX:CEX ratio, while perpetual trading volume on DEXs also hit an all-time high of $898 billion. This marked transition toward decentralized platforms reflects changing trader preferences and the increasing maturity of DeFi infrastructure. CoinGecko’s 2025 Q2 report provides detailed insights into these trends, covering market performance, key protocols, and the shifting dynamics between centralized and decentralized crypto ecosystems.

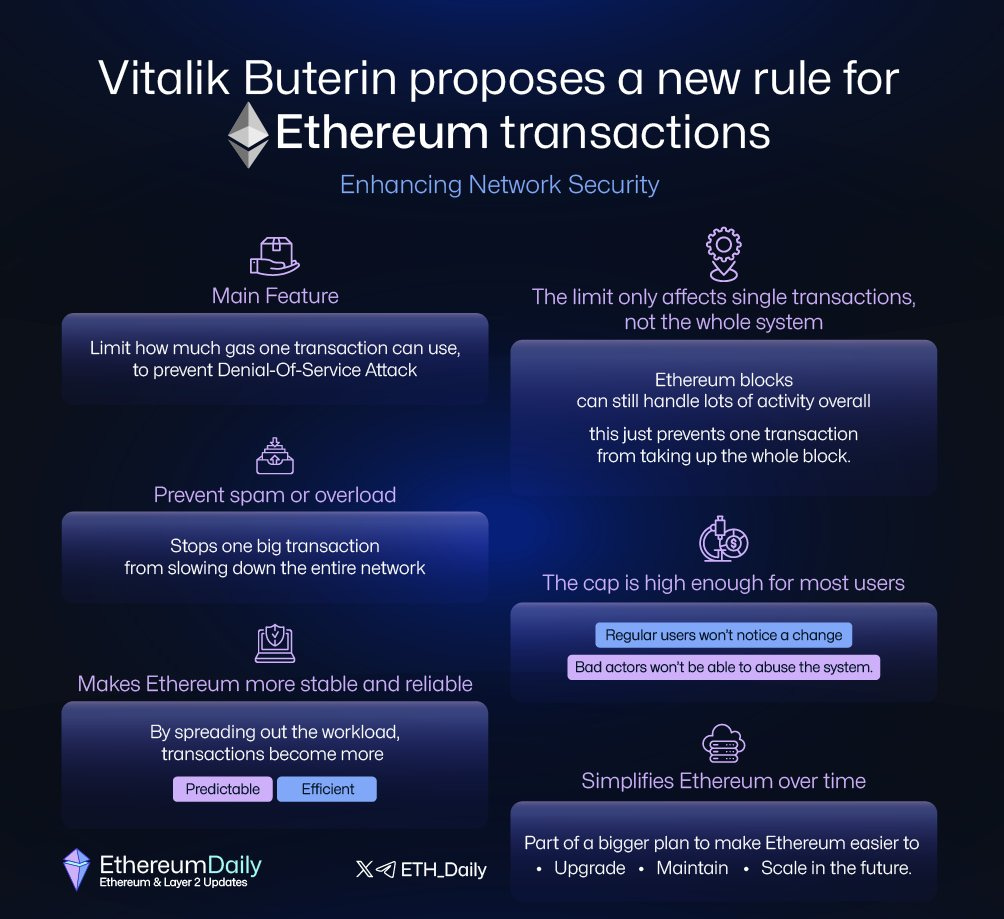

ETHEREUM- Vitalik Buterin proposes a new transaction rule to boost security & stability

▫ Set a gas limit per transaction to prevent spam & DoS attacks

▫ Stops one huge tx from clogging the network

▫ No impact on regular users — only bad actors are affected

▫ Keeps blocks efficient & predictable

▫ Part of a bigger plan to make Ethereum easier to scale, maintain, and upgrade

A subtle but powerful shift for Ethereum’s future

Crypto Jobs

To read beyond this point, please consider supporting us at Cryptofada Newsletter

With just $2 weekly, you will support the newsletter and access 100% of the Defi/Crypto opportunities we share at least twice weekly:

What to expect:

👉 Every Monday: Ecosystem/Mainnet/funding updates, Defi Yield farming, Staking Airdrops, Research/reports, ICO/IDO/Presales and Crypto Jobs and trading opportunities

👉 Every Thursday: Protocol Spotlights, with in-depth analysis of 2-5 select protocols or tokens, and yield farm opportunities.

N/B:

Free Subscribers: Have access to 20% of the content as an overview

Paid Subscribers: Have access to 100% of the contents and community features like chat room (10x alphas are shared on the chat room) etc

Keep reading with a 7-day free trial

Subscribe to Cryptofada Research to keep reading this post and get 7 days of free access to the full post archives.